eBusiness Weekly

Chris Chenga

The Sub-Saharan economic outlook has not changed much. Asset managers, research consultants, and global institutes have conjured up the same assessments on us for years. The only difference year to year is whether they are optimistic or pessimistic; no significant differentiation. This is little surprise as intellectually, our own economic philosophies and imagination have not gone through noteworthy inflection points.

In contrast, Europe has rolled through multiple ideologies ranging from Keynesian, statism, monetarism, to free market convictions. In the 1960s the Western world transitioned from commodity backed currencies to fiat currencies. In the 1980s, a few capable Asian countries transformed through almost exploitative frugal labour intensive manufacturing. All these represent notably radical inflection points that fundamentally shifted the nature of economies in these regions.

Sub-Saharan Africa has not experienced such a shift to these extents. Our philosophies and imagination remain fixed on static conventions, of which most are prescribed for us. Resource revenues, jobs through manufacturing, and demographic dividend, are a few of these conventions.

Yet, they have not been empirically proven as incontestable in their ability to fundamentally shift our economies. We must identify the limitations of these conventions, and lead an inquisition to our own radical inflection points that hopefully fundamentally shift the nature of our economies.

The commodity revenues we do not control

There is no doubt that natural resources provide significant importance to developing countries. However, the value of these minerals like all other commodities are determined by cyclical market factors of demand and supply. Hence, prices of these minerals, often leveraged for exports by our economies, fluctuate according to the cyclical interaction of market forces.

Unfortunately, our fiscal responsibilities do not fluctuate in any traceable form to commodity prices. In fact, fiscal responsibilities consistently rise regardless of the fluctuations in commodity prices. This causes what are referred to as macro-economic imbalances where the fiscal capacity of an economy struggles to match the responsibilities that sustain an economy’s well-being.

Source: US Energy Information Administration

More disconcerting should be the fact that few developing nations supply commodities at a capacity that make them price makers on global markets. That diminishes any consequential control on macro-economic balance. Thus, the premise of our relationship with creditors is founded on an imperative that we have absolutely no control over.

Some nations cannot depend on commodity prices to balance budgets

As per the oil example, Nigeria is the most populous nation in OPEC with 177 million citizens. That is a lot of fiscal responsibility. But because it only supplies 3 percent of global oil (Angola supplies less than 1 percent), it depends on a price taking resource to meet its responsibilities. So for a nation that depends on oil for 90 percent of its foreign exchange and 80 percent of fiscal revenue, it evidently has no control over its macro-economic balance.

In 2014, Nigeria needed oil prices to be $119 per barrel for fiscal break-even. After reaching monthly peaks of $112 and $105 per barrel of crude oil (oil has two benchmarks, Brent and West Texas Intermediate), global prices fell to $62 and $59 per barrel within six months. Nigeria’s revenues dipped by as much as 50 percent. Yet, fiscal responsibilities as reflected by national budgets did not fall. This is how resource dependent developing nations shift into deficits.

This is not a rigid analysis, the Nigerian oil example is credible benchmark for all resource dependent countries, including Zimbabwe. So this is the true scenario that uniformly defines us. We have no active control over ensuring that our greatest economic means of resource revenue can actually sufficiently provide for our responsibilities. Structurally, we have no control over making ends meet.

It gets more difficult for debtor nations. Macro-economic imbalances tend to be the greatest circumstance to influence the relationship between debtor and creditor countries. Macro-economic balances define the relationship between us and multilateral creditors such as the World Bank and IMF, as well as with private and institutional investors that extend us credit through bonds and sovereign debt. This means that the costs we incur to borrow are also divorced from our discretion. Whether price of commodities rise or fall, coupons payments remain due regardless of earnings.

Logically, this poses the risk of perpetual debt as most prospective borrowing is done on the hopes of leveraging the trajectory of commodity prices. Without any discretion on these commodity prices, we then manage our economies with an emphasis on debt concerns, no longer fundamentally to attending to our fiscal responsibilities.

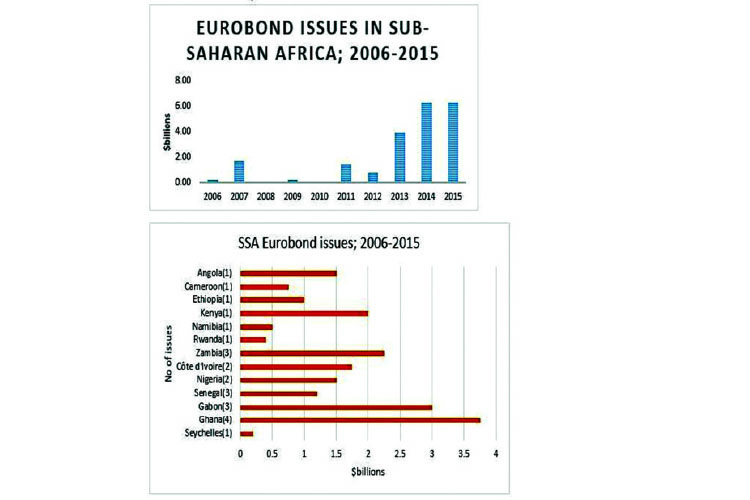

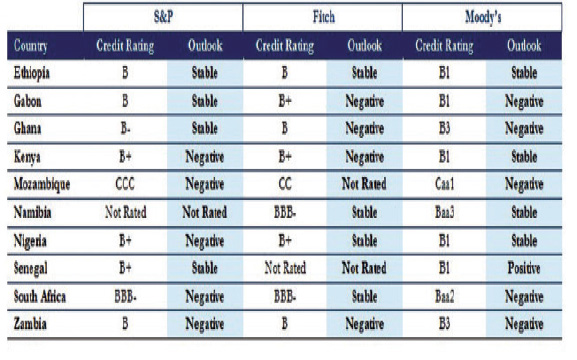

Source: Brookings Institute, Bloomberg Finance L.P., Standard & Poor’s, Fitch, and Moody’s.

Without any control over commodity prices low credit ratings will remain prevalent

This is different to a handful of resource dependent countries that have discretion over global commodity prices. In fact, they set their prices guided by their own fiscal responsibilities. So resources within themselves are not a comprehensive strategy for us, as they may be for these very few price controlling nations.

The jobs through manufacturing dream

Another conventional thought suggests that Sub-Saharan Africa can achieve mass employment by becoming a manufacturing hub, the way frugal Asian economies did it in the 1980s. This is more a hopeful fantasy. According to an enlightening research paper by the Centre for Global Development (CGD), titled “Can Africa Be a Manufacturing

Destination: Labour Costs in Comparative Perspective”, the entire Sub-Saharan region cannot contend to be a manufacturing alternative to Asian economies, except Ethiopia and that would be in extraordinary circumstance. This is due multiple reasons. With global living standards rising, and agreeable human and employee rights being understood, labour costs are now rising faster than labour productivity in manufacturing. A unit of labour can hardly produce more output than it costs to an employer.

For instance, while South Africa has 27 percent unemployment, suggesting structural unemployment, high formal wage levels make it more difficult for South Africa to assimilate the idle labour or into manufacturing. In fact, as per the CGD research, if African firms were outside Africa, their labour or costs would be only 33 percent of what they are in Africa. If comparator firms were in Africa, their labour costs would be approximately 1,9 times higher.

On the other hand, capital intensive manufacturing in competitive countries has since reduced manufacturing costs of $1 of output by as much as 12 cents. A more bleak analysis would be to compare the structural conduciveness of attracting manufacturing. Sub-Saharan economies remain higher cost in terms of infrastructure, access to raw material and retail markets, economies of scale, and other variables that impact manufacturing potential. So at this point, and in the near future, there is very little convincing evidence that mass employment can come with labour or intensive manufacturing.

A misinterpreted demographic dividend

Indeed another modern convention is that of a youth dividend. But it often lacks factual research, being more of a hyped up conventional hope. The popular inclination is that a growing number of youth means more capable human resources that will inspire our region more productive and competitive. That’s a mistaken interpretation. Real demographic dividend is when working age numbers can support dependents. That means there should be less births and retirees as the working age demographic grows. That is not what is happening in our region.

Demographic dividend is perhaps the most abused notion on progressive strategy for us, and in instances it actually contradicts the previous notions of resource revenue and jobs through manufacturing. Consider for instance, very few youth would be willing to work in deplorable labour manufacturing conditions that saw a generation in Asia sacrifice their dignity and personal well-being. Our youth is more conscious of and desires living standards, with human and employee rights, that make our economies unfitting for low cost labour intensive manufacturing.

Secondly, more births, longer life expectancy are preceding employed and productive working demographics. This is causing difficulty in macro-economic balance. There is growing responsibility to provide decent public services to all these demographics without the adequate productivity. Consider the esteem in SDGs that include good health and well-being, quality education, clean water and sanitation. Our growing populations add to recipients of these SDGs. This is more fiscal pressure entrapping our governments in debt. Thus with our structural outlook, our demographic trends are in fact more of a risk than an opportunity.

There is a calling for diversification

The notion of diversification remains vague. It is a hopeful theme that assumes the discovery of new sectors and ways of means for Sub-Saharan economies. Whichever sectors these may be remains open to bold philosophy and imagination. This is why the notion of diversification should become more attractive to us as a region.

The aforementioned theories of growth are evidently limited, so are the theories of a fourth industrial revolution of which we are already marginalized from effecting. So perhaps any potential for transformational growth avenues can be found in this theme of diversification.

Diversification, for us, could mean the kind of radical outlier event as those that fundamentally transformed other regions. Unfortunately, our economic governance and diverse stakeholders, seem not to push conventional understanding to its very limits, and perhaps over the edge into territory unseen.

Think outside the box

The chosen tone here one intended to raise a more acute self-awareness to the challenges that we face. It is easy, and perhaps the predominant human condition, to find comfort in generic hope. This is a danger especially if that hope is conceived from unproven or limited theories.

Take note that resource revenue, jobs through manufacturing, and growing young populations, do not exist in a vacuum. They are dependent on variables of where the global economy as a whole is going. Thus, the most potent argument advanced here is for our region to seek more control and discretion over variables of consequence; not to leave our hope to limited and exogenous circumstances as is presently the case.

Of course, that is not to discount the importance of commodities, manufacturing and young demographics. We’ll take them! But there are potentially many other avenues unexplored, hidden within the theme of diversification. Maybe we must seek them through radical philosophies and imagination that fundamentally shift the outlook of our economies.